In July 2022 Advantage Business conducted a Business Sentiment Survey, two years on from our first survey.

Quick links

Introduction

The COVID pandemic has now rolled into its third year and will be with us for the foreseeable future. Over the past three years, we have conducted a nationwide survey to gauge the impacts on the small business sector within New Zealand. Since the pandemic began, market conditions and customer behaviours have changed and continue to do so in an uncertain environment. Many small businesses still struggle with cash flow and have reduced access to working capital and investment opportunities. Government support for the small business sector has not met the expectations of small business owners.

Although vaccines are in place worldwide and herd immunity is slowly improving, many uncertainties still affect local businesses. These include labour shortages, skill shortages, supply chain issues, new government policies, drastic changes in housing and construction, and very different consumer behaviour.

While our country has done well to contain the local spread of the virus thus far, the outlook for our economy remains uncertain, especially given our border restrictions which affect our interconnectedness with global trade, finance and geopolitics.

Advantage Business is a well-established business advisory company that has worked with small and medium-sized businesses around New Zealand for over two decades. We want to know, as best possible, what are the current impacts of the pandemic on the SME sector in New Zealand. Therefore, we have implemented our third annual survey to collect data from small business owners throughout New Zealand about how COVID, and other structural influences, will likely affect their businesses over the coming twelve months.

We were most interested in the following issues and how they directly impact SME businesses in New Zealand:

- What are the changing market conditions?

- How have customer behaviours changed?

- Do SMEs have enough cash flow and working capital?

- Are there new investment opportunities?

- Are there any unexpected positive outcomes from the crisis?

- Has their use of technology changed?

- Have levels of government support for SMEs been adequate?

- Has support from the banking sector been adequate?

- What areas need the most support in their business?

Sample

The survey ran in July 2022. Participants provided feedback and predictions for the twelve months from July 2022 to August 2023. There were 56 respondents from the Advantage Business audience with a regional spread throughout New Zealand.

Results

3.1 CHANGING MARKET CONDITIONS & BORDER CLOSURES

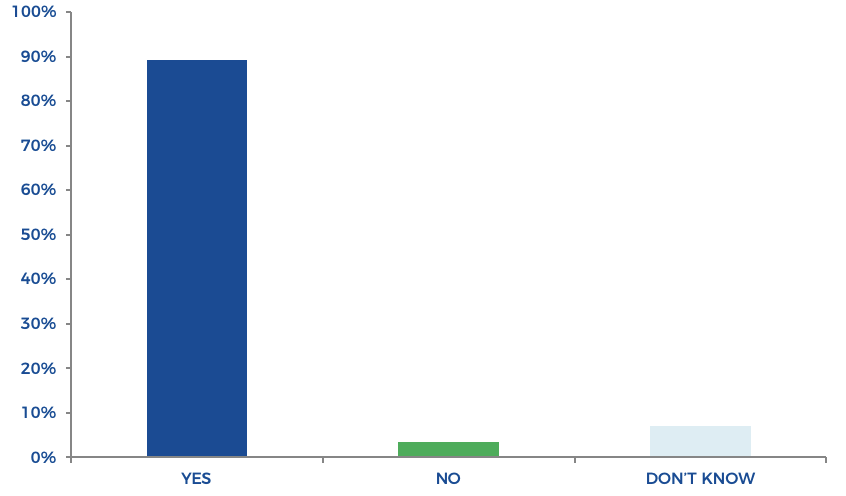

A strong majority (89.3%) of small business owners believe that changed/changing market conditions will impact their business in the next twelve months. This is up from 79.4% twelve months ago. 3.6% believe there will be no change (down from 8% last year) and just over seven per cent don’t yet know (down from thirteen per cent last year, Overall, this paints a more pessimistic view held by respondents about current and likely market conditions for businesses in New Zealand.

Are changed/changing market conditions likely to impact your business within the next 12 months?

When asked for further comments, the majority of respondents thought that changing market conditions would negatively impact their business. While, last year, the major concerns included difficulties in the global and domestic supply chains, along with major uncertainties around labour supply. This year’s concerns are more focused on the impacts of inflation and the growing likelihood of a recession. For example:

“There are wildly increasing costs, transport, raw ingredients and labour!”

“The economic outlook always affects our business and at the moment people do not like what they see of the near future”.

“Inflation is driving price hikes and uncertain FX outlook”.

“Availability of raw materials. Inflation affects clients purchasing decisions and our profitability”.

Supply lines and shipping remain a major concern:

“People want work done but don’t pay on the 20th of the month. They stretch it out for up to 90 days”.

“Cost of materials impacted. Also cost of shipping. Our raw material costs are hugely impacted. As well as significant delays in the supply line”.

“Access to materials, delays in construction sector flowing through”.

There was ongoing concern about the impacts of border closures and the lack of international travel. This had had spin-off effects in retail and services. For example:

“There is reduced tourism and overall customer demand”.

“Borders need to fully open for clients to return”.

“We sell luxury goods. In a recession the market slows for these products”.

Overall, the theme of comments is that there is a significant slowdown in all parts of the economy. For the past two years, this sentiment was applied only to parts of the economy. While COVID remains in the community, business owners are most concerned about inflation, less consumer spending, shipping supply lines and labour shortages. While the tourism and construction sectors were identified as struggling sectors over the past two years, businesses across the entire New Zealand economy are now reporting an extremely difficult operating environment.

3.2 CHANGING CUSTOMER BEHAVIOUR

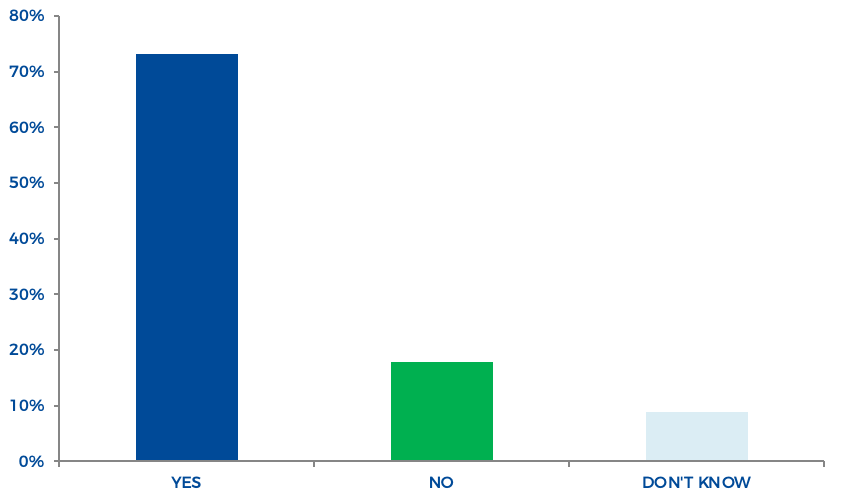

Respondents were asked, “Have there been any recent changes in your customer behaviour that have influenced changes in supply and demand?” A large majority (73.21%) replied “Yes”, while 17.86% replied “No” and 8.93% replied, “Don’t Know”.

Have there been any ongoing changes in your customers’ behaviour that have influenced changes in supply and demand?

Last year respondents reported changes in customer behaviours that included; changes to buying behaviour, concerns about rising prices, a falloff in export sales, reactions to supply issues and changing expectations around lead times. In 2022, respondents listed the major changes as, customers becoming more demanding and stressed, some spending less, and more “price-based” buying. For example:

“People are very impatient wanting their jobs done straight away trying to push ahead of other scheduled work”.

“Customers are more stressed and having to constantly change plans to get what they can when they can”.

“They want things straight away and we are having to hold onto more stock to maintain the prices they are used to”.

“When traffic light kicked in all my retired women customers stopped engaging”.

“More people staying home/working from home is affecting retail and hospo businesses”.

3.3 CASH FLOW AND WORKING CAPITAL

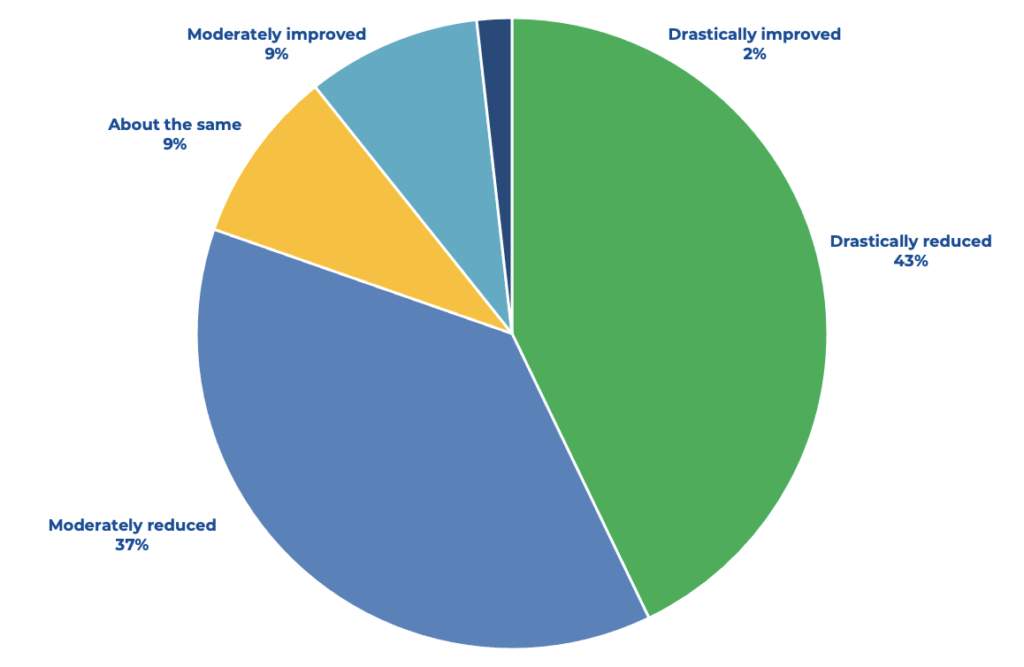

Eighty per cent of small businesses expect their cash flow to reduce either drastically (42.9%) or moderately (37.5%) during the next twelve-month period. Last year, those expecting a drastic reduction were only thirteen per cent. Only 17.9% expect their cash flow to be either about the same or moderately improved and just 1.8% per cent expect a drastic improvement.

How would you describe the likely impacts of the pandemic on your cash flow over the next 12 months?

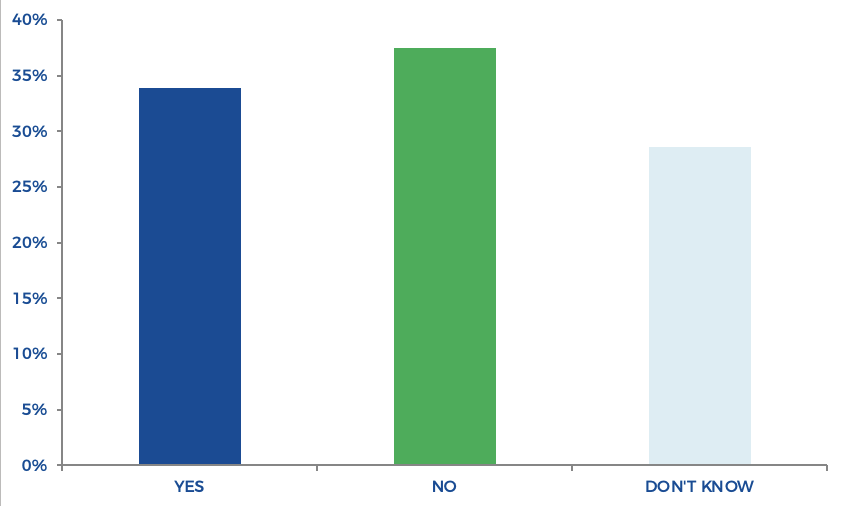

In terms of the working capital, businesses can make available to both keep operating and/or take advantage of any growth opportunities, 33.9% of respondents think they will have adequate amounts to invest in plant, equipment and other assets during the next twelve months. Concerningly, 37.5% think they will not have enough working capital and 28.6% don’t know. The most significant change in last year’s results is that, in 2021, 67.4% of respondents expected to have enough working capital, nearly double the amount in 2022, where only 33.9% indicated that they would have enough capital and 28.6% didn’t know, up from less than one per cent.

In the next 12 months, will you have adequate working capital to invest in your business for plant, equipment and other vital assets?

3.4 INVESTMENT OPPORTUNITIES

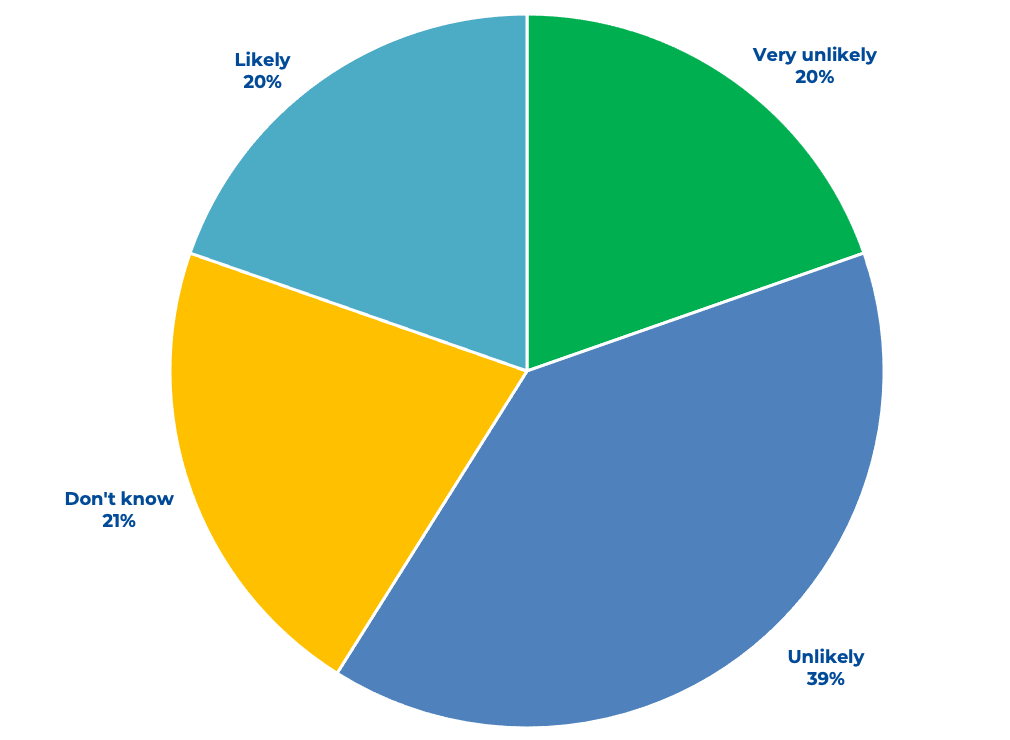

Now that the pandemic is well into its third year, businesses are less likely to base investment decisions around it. They are more likely to base decisions on current market conditions such as inflation and customer spending habits. When considering how likely, or not, small business owners in New Zealand are to invest in new opportunities due to COVID, 58.9% stated that they were either unlikely or very unlikely to do so.

How likely are you now to invest in new opportunities as a result of the pandemic?

3.5 UNEXPECTED OUTCOMES

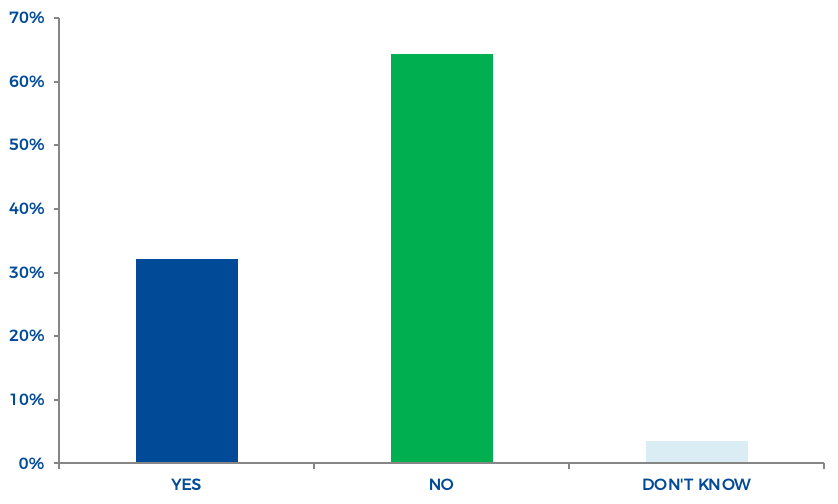

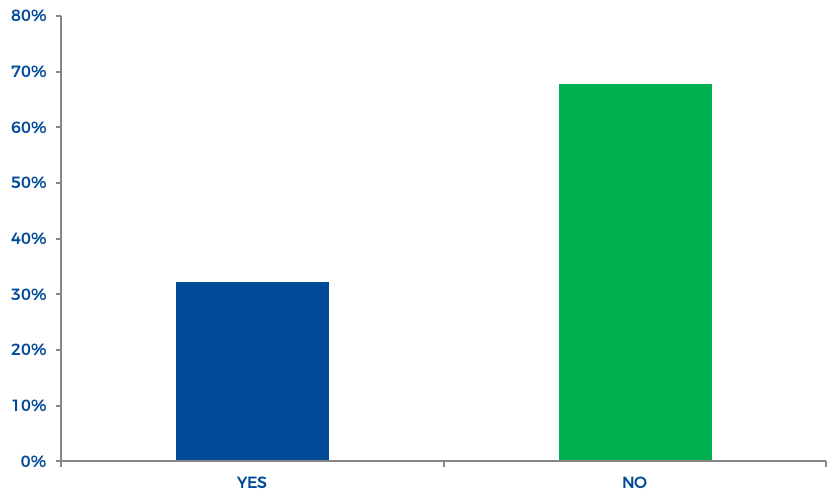

The phenomenon of businesses transforming themselves in response to the unexpected outcomes of the Covid pandemic slowed dramatically in 2022. When asked about any unexpected positive outcomes for their business as a result of Covid, 32.1% replied that they had experienced unexpected positive outcomes compared with 60.9% a year ago. A more pessimistic view of the economy is reflected in 67.9% now stating that they had seen no positive unexpected outcomes, compared with 39.1% a year ago.

Have there been any unexpected positive outcomes for your business as a result of the pandemic

3.6 USE OF TECHNOLOGY

For the majority (64.3%), the use of technology in their business has not changed as a result of COVID. However, 32.1% of respondents reported that changes in the use of technology have been altered because of the pandemic. These include more remote working from home, more use of online meeting programmes such as Zoom and Teams, more use of tablets for real-time field reporting, more online purchases and increased advertising of products on social media.

Has the pandemic affected the use of technology in your business?

3.7 GOVERNMENT SUPPORT

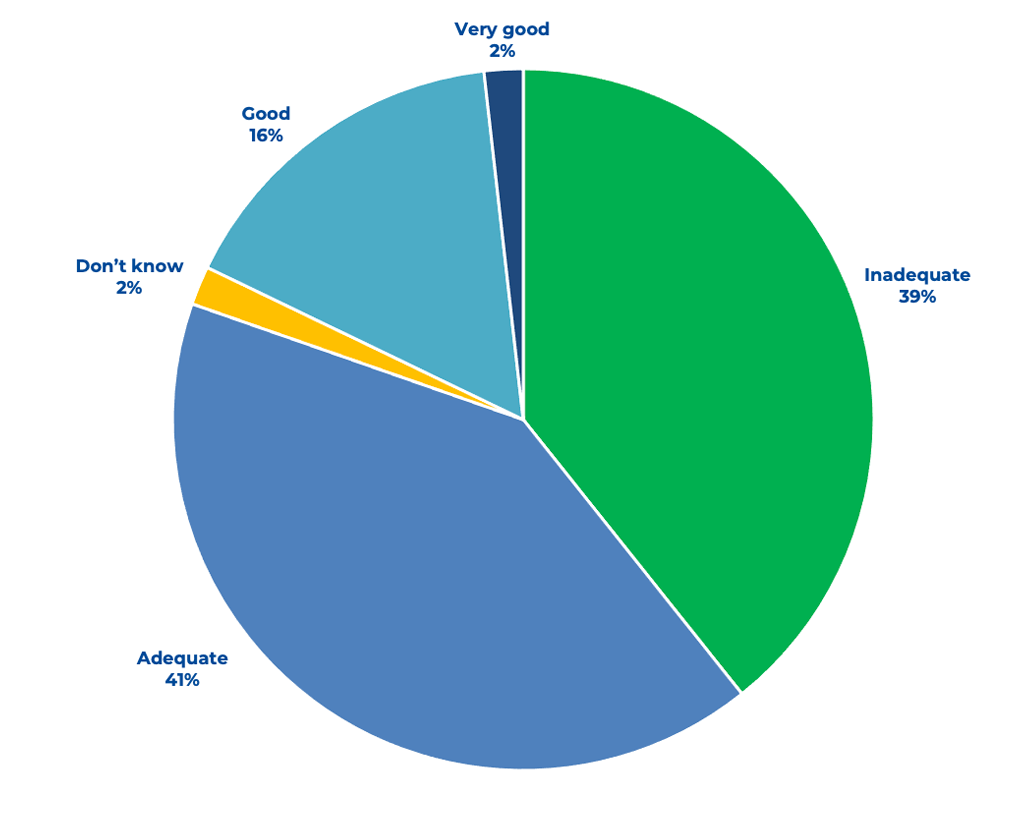

Respondents were split when asked to describe levels of government support for small businesses during the pandemic. 41.1% described the support as adequate, 39.3% thought the government response has been inadequate, 16.1% thought it was good and only 1.8% thought it was very good. This is a similar result to last year except for those who thought the government response to helping businesses through COVID was “very good” at 1.8% compared with 9.8% in 2021.

How would you describe levels of government support for small businesses coping with the pandemic during the past year?

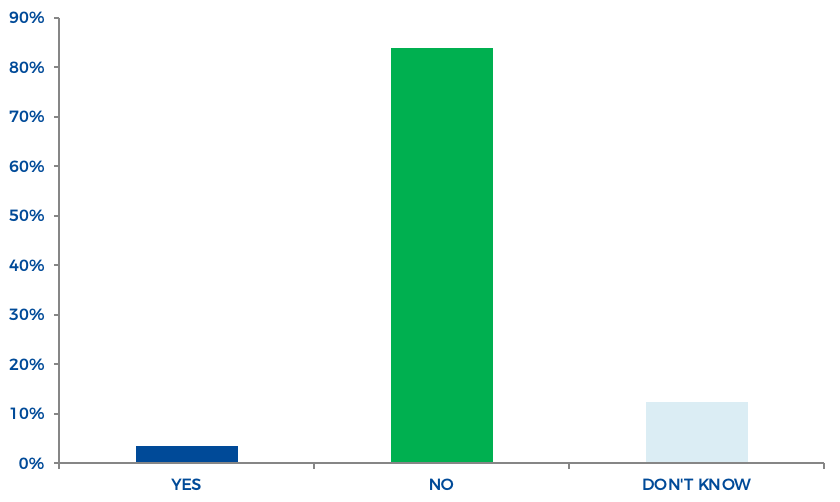

For the second year, New Zealand businesses strongly think that they are not well represented at the central government level. Respondents were asked, “Do you think small and medium-sized businesses are represented adequately at the central government level?” Only 3.6% replied yes, while 84% said no and 12.5% didn’t know. This compared with 12% who replied “yes” and 88% who replied “no” in 2021.

Do you think small and medium-sized businesses are represented adequately at the central government level?

3.8 BANKING SECTOR SUPPORT

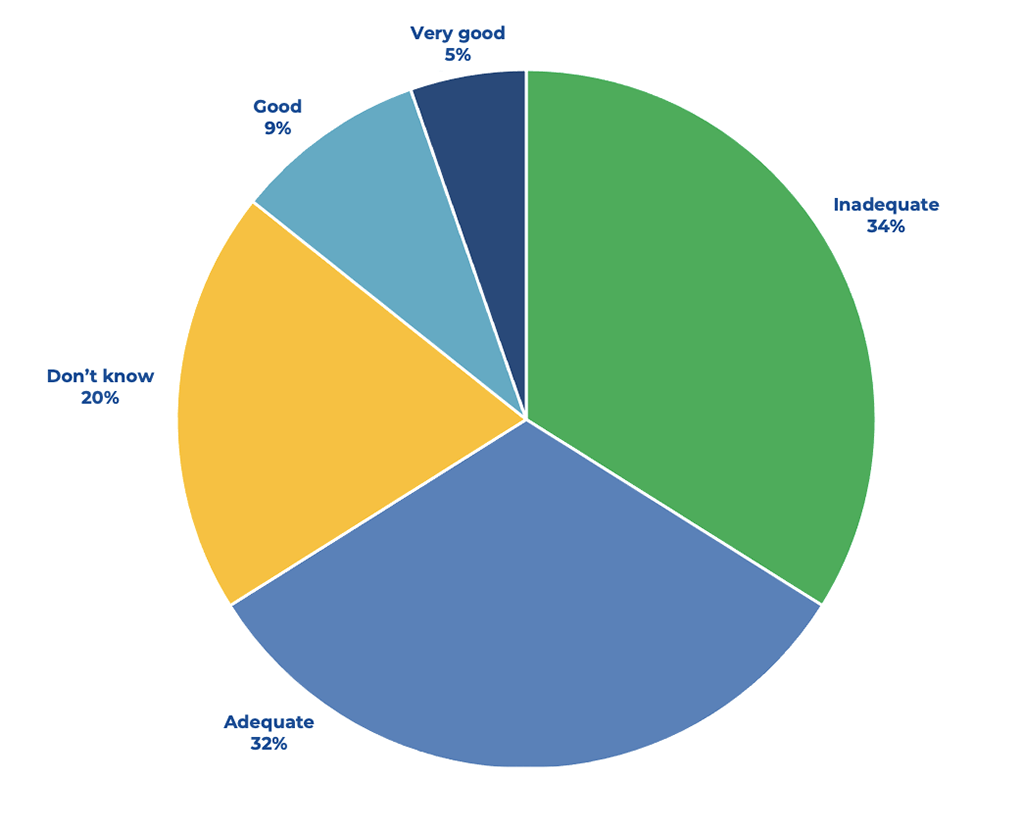

There has been a decline in the perceived support businesses have received from the banking sector in 2022. When asked to describe the level of support from the banking sector during the pandemic, there was a range of responses. 34% of respondents thought the response was inadequate, 32.1% thought it was adequate, 19.6% didn’t know, 8.9% thought it was good and 5.3% thought it was very good. In 2021, 23,9% thought that support was inadequate, 39.1% that it was adequate, 15.2% didn’t know, 10.9% thought it was good and 12% thought it was very good.

How would you describe the level of support from the banking sector during the pandemic over the past year?

3.9 BUSINESS SUPPORT NEEDS

Our first Business Sentiment Survey in 2020 was conducted relatively soon after nationwide Level Two lockdown restrictions were ended. Last year, the survey took place in a time of a suspended travel bubble between NZ and Australia; the early stages of vaccine rollout in New Zealand; and the rise of the Delta variant. This threatened the population with more snap lockdowns as and when it took hold.

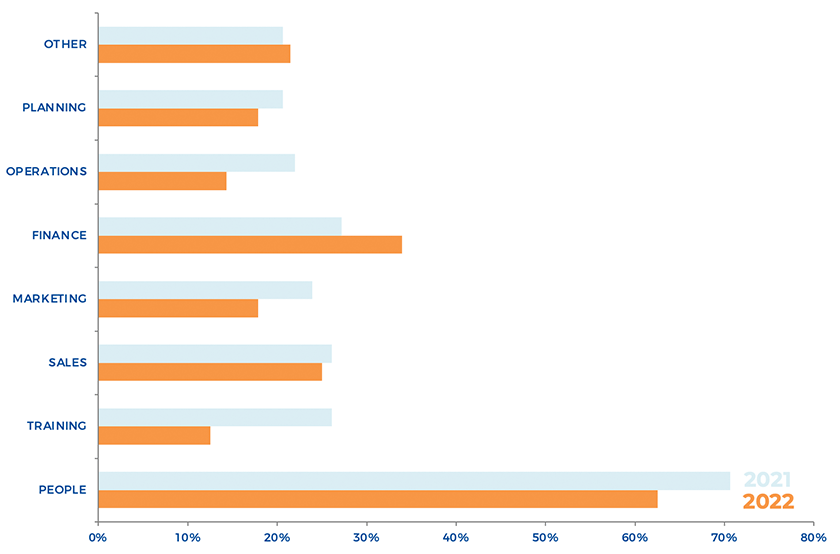

This year, although still at the “Orange” setting to protect our health system, the lockdowns have ceased and the borders have reopened. In this context, small businesses identified their main needs in support as the following. People (62.5%), Finance (33.9%), Sales (25%), Marketing and Planning (both 17.9%), Operations (14.3%), and Training (12.5%). Compared with 2021, there is a small decrease in the importance put on People (70.6% in 2021), an increase in Finance (27.2% in 2021), a decrease in Marketing and Planning (23.9% and 20.6% in 2021) and a decrease in Training (26.1% in 2021).

We were most interested in the following issues and how they directly impact SME businesses in New Zealand:

- What are the changing market conditions?

- How have customer behaviours changed?

Thinking about your business coming through the pandemic, for which areas are you most needing support?

Conclusion

In mid-2020, the major concerns from small businesses related to a slowdown of construction and infrastructure projects. Last year, key concerns were around difficulties in the global and domestic supply chains, and major uncertainties around labour supply. Border closures had eliminated most international travel. While there was more domestic Kiwi travel and local spending, there was an awareness that a significant slowdown in some sectors of the economy would be ongoing.

In 2022, the effects of that slowdown, while still being played out, continue to be very damaging at the small business level. Most business owners believe that changed/changing market conditions will impact their business in the next twelve months. The majority think that changing market conditions will negatively impact their business. Key concerns are focused on the impacts of inflation and the growing likelihood of a recession. Supply lines and shipping remain a major concern and there is ongoing concern around the impacts of border closures and the lack of international travel with the borders only recently reopened.

Business owners report significant changes in consumer behaviour in 2022 that are having an impact on supply and demand. These include customers being more demanding and stressed some spending less, and more “price-based” buying. Circumstances are tighter, with 80% of small businesses expecting their cash flow to reduce either drastically (42.9%) or moderately (37.5%) during the next twelve-month period. Concerningly, 37.5% also think they will not have enough working capital and 28.6% don’t know.

In terms of investment opportunities, businesses are more likely to base their decisions on current market conditions. Factors such as inflation and customer spending habits will influence them, rather than direct results of the pandemic. A more pessimistic view of the economy is reflected in 67.9% stating that they had seen no positive unexpected outcomes in 2022, compared with 39.1% a year ago.

Perceptions of support for small businesses from the central government remain similar to a year ago. Approximately forty per cent view it as adequate and just under forty per cent inadequate. There was a noticeable drop of eight per cent in business owners who thought that support was very good. For the third year, New Zealand businesses strongly think (84%) that they are not well represented at the central government level.

There has also been a decline in perceived support for businesses from the banking sector in 2022.

Overall, the feedback from small businesses in New Zealand is that the economy is tougher for them than a year ago. They do not expect that to change drastically in the short term. Perceptions of the pandemic as having direct impacts on their businesses have diminished. However, these have been replaced by growing indirect impacts including inflation, the likelihood of recession, supply line disruptions, labour supply and long-term border closures.

Businesses are struggling, especially in the areas of people, finance, sales and marketing. With perceptions of limited support from both the central government and the banking sector, it is now even more crucial that small businesses seek independent advice and support. Advantage Business Advisors can guide them through the difficult times currently faced. We can provide clear pathways to consolidate, develop and grow their people, markets and efficiencies in performance.

We hope you have found our Business Sentiment Survey useful. For more information contact:

Dr Dominic Moran | Partner | Business Advisor