In June 2020 Advantage Business conducted a Business Sentiment Survey. With so much uncertainty, it felt timely to ‘ask the audience’ what impact the pandemic was having on New Zealand’s SME sector.

Quick links

Introduction

The COVID-19 global pandemic is unparalleled in recent human history. Its impacts on New Zealand are yet to be fully realized. While our country has done well to contain the local spread of the virus thus far, the outlook for our economy is very uncertain. Our interconnectedness with global trade, finance and geopolitics make this especially true.

Advantage Business is a well-established business advisory company. It has worked with small and medium-sized businesses around NZ for over two decades. We want to know, as best possible, what are the likely impacts of the current pandemic on the SME sector in NZ. Therefore, we have implemented this survey to collect data from SMEs throughout NZ. We asked them how COVID-19 has and likely will, affect their businesses over the coming twelve months.

We were most interested in the following issues around COVID-19 and how they directly impact on SME businesses in NZ:

-

-

-

- What are the changing market conditions?

- How have customer behaviours changed?

- Do SMEs have enough cash flow and working capital?

- Are there new opportunities for investment?

- Are there any unexpected positive outcomes of the crisis?

- Has their use of technology changed?

- Have levels of government support for SMEs been adequate?

- Has support from the banking sector been adequate?

- What areas need the most support in their business?

Sample

We conducted the survey during June 2020, asking participants to provide feedback for the twelve months from June 2020 to July 2021. There were 92 respondents from the Advantage Business database with a regional spread throughout New Zealand.

Most industry sectors were included with manufacturing and construction featuring prominently followed by other services, retail trade, professional services, agriculture, forestry & fishing and wholesale trade.

Businesses typically had annual revenue of $15m or less. Thirty-four per cent had 1-5 employees, fifteen per cent had 6-9 employees, twenty-one per cent had 10-19 employees and thirteen per cent had 20-49 employees. Thus, the 92 respondents provided a strong cross-section on the SME sector in New Zealand.Results

CHANGING MARKET CONDITIONS & BORDER CLOSURES

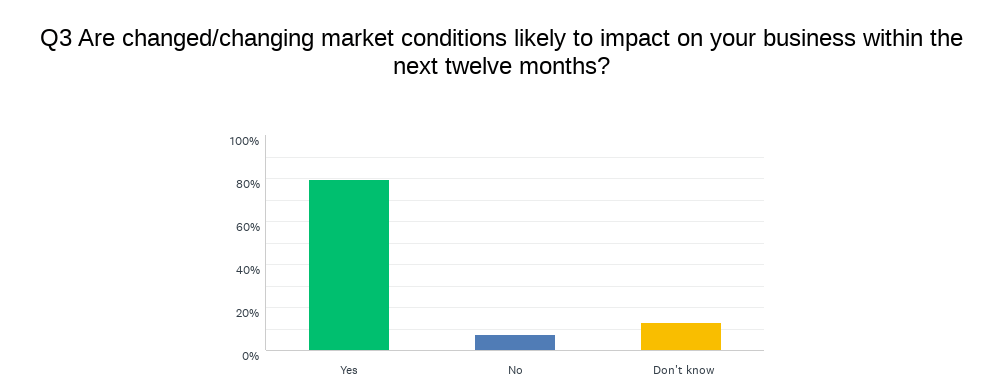

A very high majority, (79.4%) of SME owners believe that changed/changing market conditions will impact their business in the next twelve months. Just under eight per cent believe there will be no change and thirteen per cent don’t yet know.

When asked for further comments, the majority of respondents thought that changing market conditions would negatively impact their business. Key concerns were in a slowdown of construction and infrastructure projects. For example:

When asked for further comments, the majority of respondents thought that changing market conditions would negatively impact their business. Key concerns were in a slowdown of construction and infrastructure projects. For example:“The construction industry is in for a hard time over the 36 months, maintenance will be more important.”

“So much unknown in our industry (construction)- Will the guy we are working for today be here tomorrow or have work tomorrow. All is unknown.”

Another concern was around the weakening of supply chains, especially in the tourism and hospitality sectors. For example:

“We need our clients up to speed and they are dependent on their clients – any negative impact up the supply chain hurts us.”

“Foodservice customer uncertainty – (especially) when it’s linked to tourism.”

Overall, the theme of the majority of comments was that a significant slowdown in the economy is imminent. The flow-on effects of that slowdown, while still being played out, could be very damaging at the SME level.

When asked “What impact will NZ border closures of three months or more from now mean for your business?” There were eight positive comments, thirty provided negative comments and forty-three neutral comments.

Positive comments about the impacts of border closures on respondents’ businesses included:

- less money being spent by Kiwis going overseas

- increased demand for local produce and “buy local”

- and a reduction of inferior imported products.

Negative comments focused on direct impacts due to border closures. Also the flow-on effect of other businesses further up the supply chain having an impact. For example:

“… depends on how many of our clients’ clients are impacted. Best case is neutral, most likely is negative, unsure to what degree. There is no possibility of a positive outcome.”

“We are 99.5% reliant on international tourism so we are treading water and trying to get domestic tourists instead.”

“Slow delivery of critical parts, skilled immigrant workers’ availability.”

CHANGING CUSTOMER BEHAVIOUR

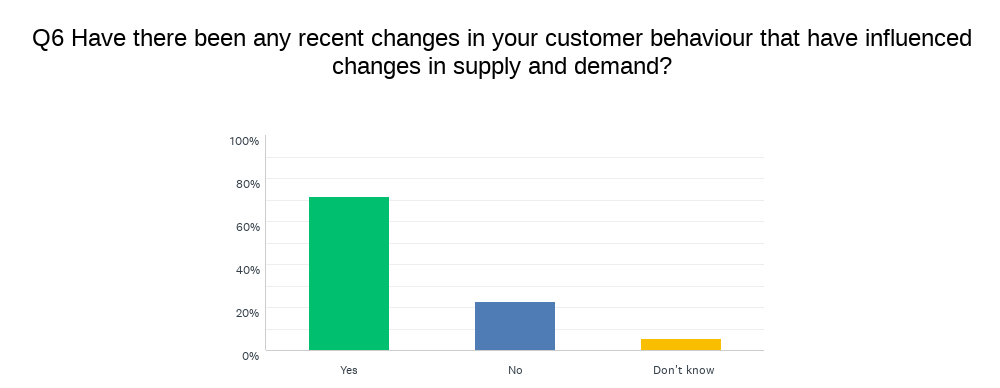

Respondents were asked, “Have there been any recent changes in your customers’ behaviour that have influenced changes in supply and demand?” A strong majority (71.7%) replied “Yes”, 22.8% “No” and 5.4% “Don’t know”.

When asked for further comments, respondents reported a wide range of changes in customer behaviours, including both positive and negative. They also revealed some more complex and perhaps far-reaching influences on customer behaviour.

When asked for further comments, respondents reported a wide range of changes in customer behaviours, including both positive and negative. They also revealed some more complex and perhaps far-reaching influences on customer behaviour.Of the fifty-nine comments received on this topic, forty-three (72.9%) reported uncertainty and/or reduced buying activity on the part of their customers. This included holding back on projects, reduced ability to pay, the demise of tourism and hospitality, spending less, reduced orders and a more conservative approach. There was also concern that the downturn will result in less investment in people and staff development.

Sixteen comments (27.1%) reported positive changes in the behaviours of their customers. These included:

- a willingness to buy local

- adopting new technologies including purchases and online consults

- and a willingness for businesses to change and adapt to changing customer demands.

For example:

“(There is a) move to taking costs out of businesses and looking to outsource and we are an outsourcing option – so good for business.”

CASHFLOW AND WORKING CAPITAL

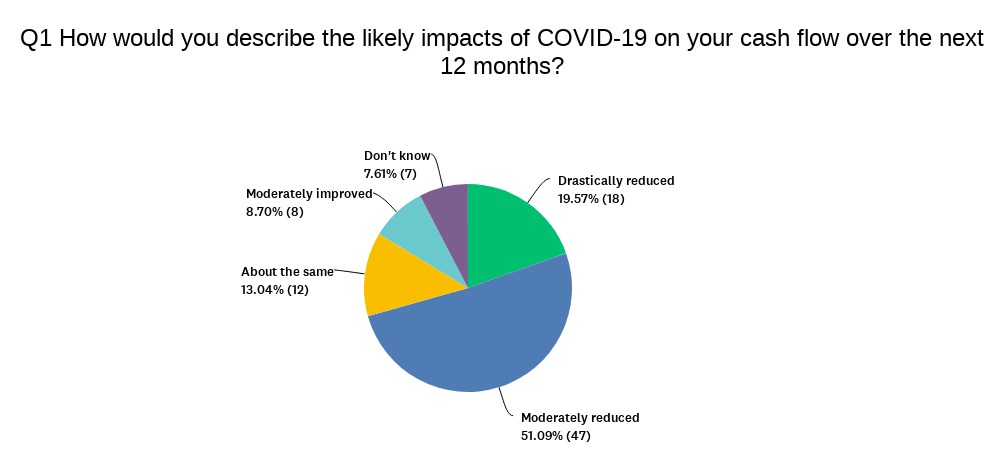

Seventy per cent of SME businesses expect their cash flow to reduce either drastically (19.6%) or moderately (51.7%) during the next twelve-month period. Thirteen per cent expect their cash flow to be about the same, while nine per cent expect a moderate improvement and eight per cent don’t yet know.

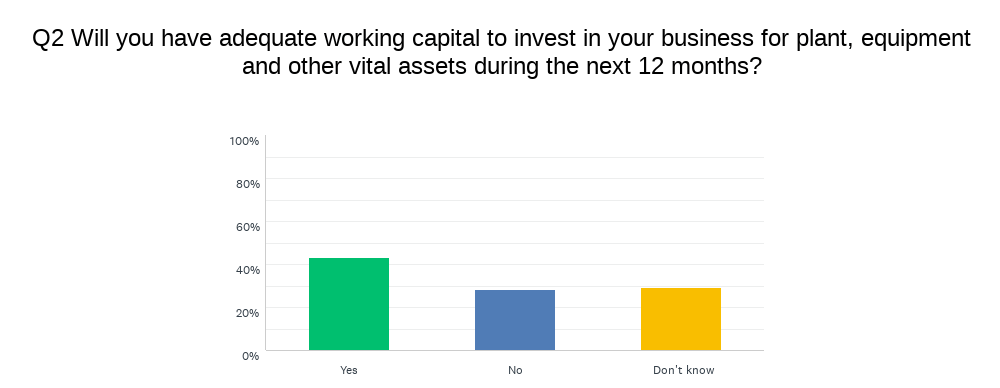

In terms of the working capital that businesses can make available to both keep their businesses operating and/or take advantage of any growth opportunities, only 43.5% of respondents think they will have adequate amounts to invest in plant, equipment and other assets during the next twelve months. 28.3% think they will not have enough working capital and 29.4% don’t know.

In terms of the working capital that businesses can make available to both keep their businesses operating and/or take advantage of any growth opportunities, only 43.5% of respondents think they will have adequate amounts to invest in plant, equipment and other assets during the next twelve months. 28.3% think they will not have enough working capital and 29.4% don’t know.

INVESTMENT OPPORTUNITIES

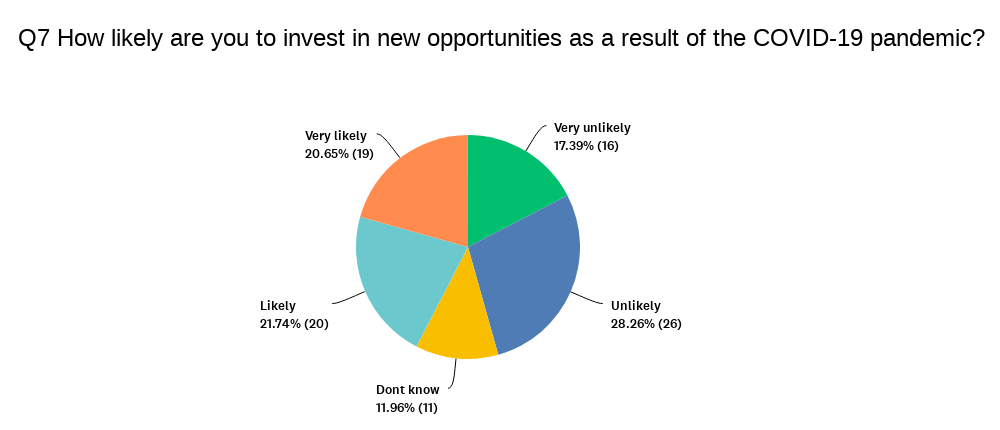

When considering how likely, or not, small business owners in New Zealand are to invest in new opportunities due to COVID-19 there was a mixed response. 45.7% were either unlikely or very unlikely to invest, 42.4% were either likely or very likely to invest while twelve per cent don’t yet know.

UNEXPECTED OUTCOMES

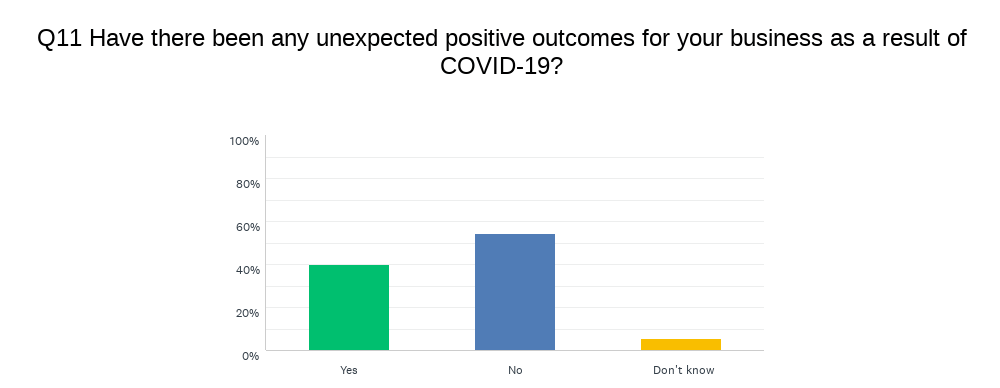

When asked about any unexpected positive outcomes for their business as a result of COVID-19, 40.2% replied that they had experienced unexpected positive outcomes, 54.4% said they hadn’t and 5.4% didn’t yet know.

For those businesses that did experience positive change, some reported doing more business due to their industry sector or location. For example:

For those businesses that did experience positive change, some reported doing more business due to their industry sector or location. For example:- “Greater contracting opportunities.”

- “Business booming after level 4.”

- “Increased sales to meet new regulations.”

- “Positive attitude to local food.”

- “More demand for high vitamin c fruit”.

Others were taking a more proactive approach to plan and change their businesses:

- “Launched a ‘Reconfigure for recovery and wealth’ program. First round, the results for participants is exceptional. Now need to build awareness of it.”

- “An increased focus on business improvement, cashflow and funding.”

- “Change in processes.”

- “Re-visiting the organisational structure.”

- “Having to use app-based job management systems has been hard for staff to get their head around but I feel productivity will be better in the long term.”

- “Reviewed the way we do business to being smarter and more time efficient.”

- “Innovation, being forced makes the business more agile.”

USE OF TECHNOLOGY

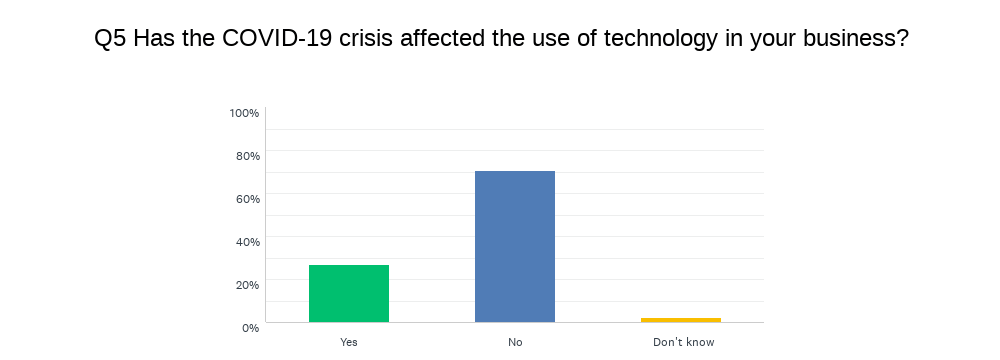

For the majority (70.7%), the use of technology in their business has not changed as a result of the COVID 19 pandemic. However, 27.2% of respondents reported the use of technology in their business altering because of the crisis. These include more remote working from home, more use of online meeting programmes such as Zoom and Microsoft Teams, more online purchases and an increase in social media advertising.

GOVERNMENT SUPPORT

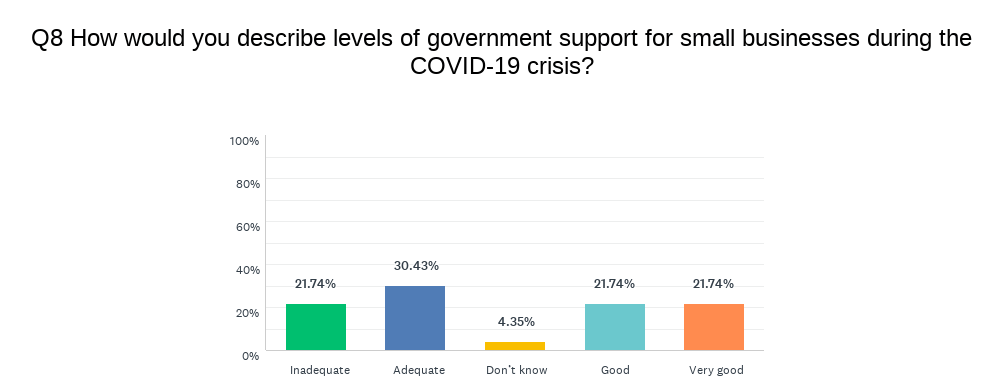

Respondents were split when asked to describe levels of government support for small businesses during the COVID-19 crisis. While 43.5% described the support as either good or very good, 52.2% thought the government response was only either adequate or very inadequate.

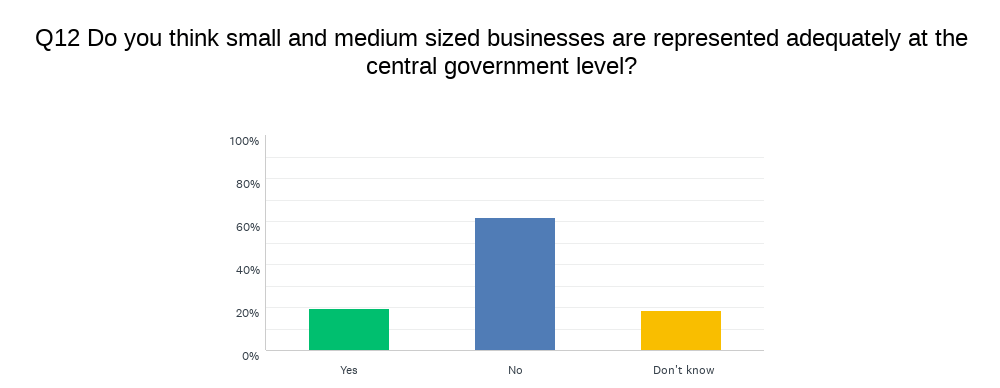

The role of central government intervention across the entire economy is a key factor in both mitigating and recovering from this global pandemic. We asked respondents, “Do you think small and medium-sized businesses are represented adequately at the central government level?” Only 19.6% replied ”yes”, 18.5% didn’t yet know and 62% said ”no”. Quite clearly, small businesses in New Zealand do not believe that central government have done enough to support them during the current COVID-19 crisis.

BANKING SECTOR SUPPORT

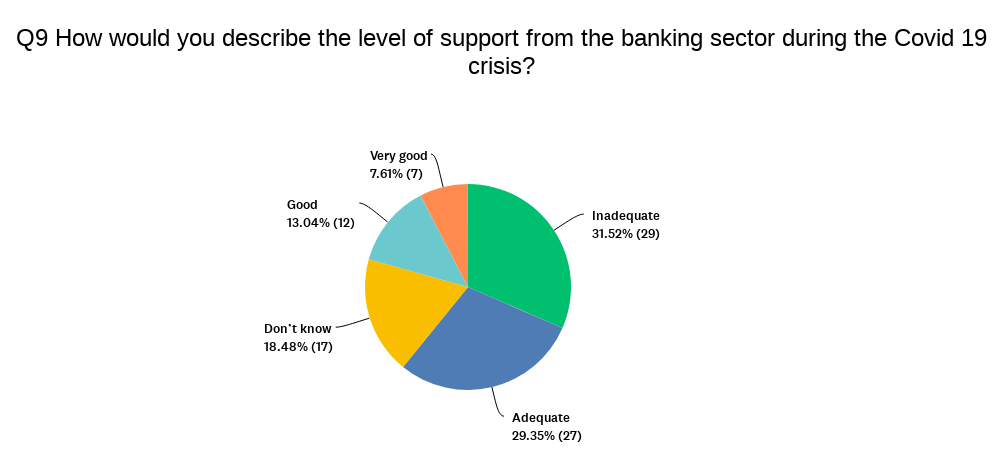

When asked to describe the level of support from the banking sector during the COVID-19 crisis, the answers were clearer cut. A total of 60.9% thought it was either inadequate or adequate. Conversely, 20.7% thought the response was either good or very good while 18.5% didn’t know.

BUSINESS SUPPORT NEEDS

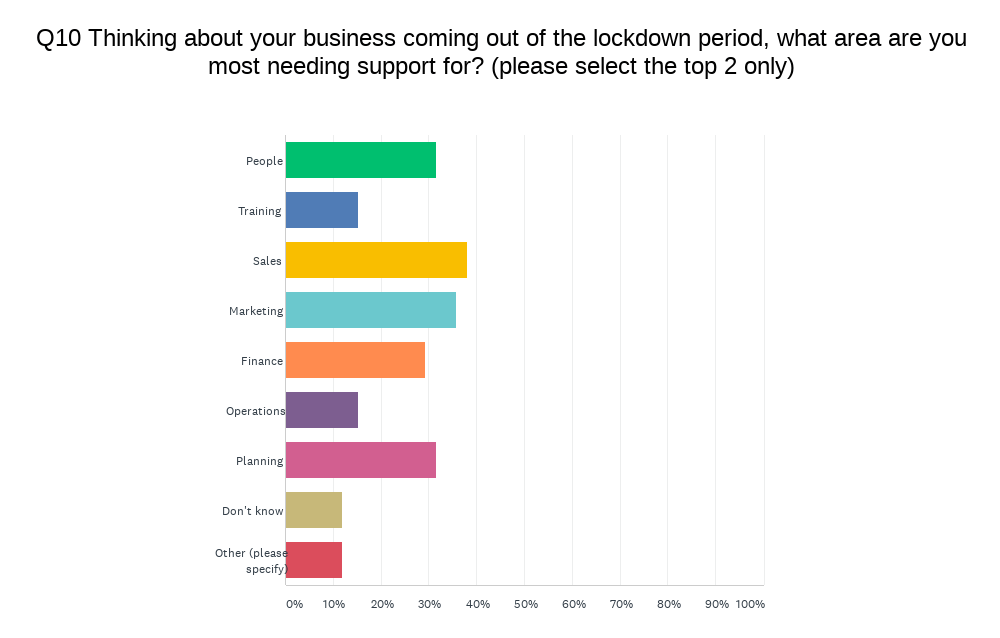

We conducted the survey relatively soon after the government ended Level Two lockdown restrictions. We asked respondents where they need the most support. They rated sales (38%) and marketing (35.9%) highest, followed by people (31.5%) and planning (31.5%) and finance (29.4%).

Analysis & discussion

The response to our business sentiment survey tells us that the COVID-19 pandemic has and will continue to have, a significant impact on the New Zealand SME sector. A significant majority (79.4%) of SME owners believe that changed/changing market conditions will impact their business in the next twelve months.

Respondents reported a slowdown in the construction sector, disrupted supply chains and a flow-on effect of border closures. These have been only partly offset by “buy local” campaigns and government support for the sector.

There have been significant changes in customer behaviour for SMEs as a result of COVID-19. Respondents reported uncertainty and/or reduced buying activity on the part of their customers. This included holding back on projects, reduced ability to pay, the demise of tourism and hospitality, spending less, reduced orders and a more conservative approach.

SME owners expect their cash flow to reduce either drastically (19.6%) or moderately (51.7%) during the next twelve-month period. Additionally, only 43.5% of respondents think they will have adequate amounts to invest in plant, equipment and other assets during the next twelve months. 28.3% think they will not have enough working capital and 29.4% don’t know.

There is some optimism about new investment opportunities resulting from COVID-19, depending on the industry sector. While 45.7% were either unlikely or very unlikely to invest, 42.4% were either likely or very likely to invest. We have already observed some unexpected positive outcomes of the crisis. These include:

- An increase in contracting opportunities.

- More “buy local.”

- Opportunities for new product development.

- A chance to re-assess and plan a new focus for the business.

There have been some changes in the use of technology. More remote working from home, more use of online meeting programmes such as Zoom and Microsoft Teams, more online purchases and an increase in social media advertising of products.

The majority of SMEs (52.2%) thought the government support relating to COVID-19 was only either adequate or very inadequate. Additionally, 62% thought the SME sector is not adequately supported at the central government level.

Support from the banking sector was similarly seen as underwhelming. 60.9% of respondents thought support from the banking sector was either adequate or inadequate.

From a ‘support and needs’ perspective, SMEs report that their greatest needs are in sales (38%) and marketing (35.9%) followed by people (31.5%), planning (31.5%) and finance (29.4%).

Conclusion

The SME sector in this country is currently meeting significant challenges. Market conditions continue to change, along with customer behaviours at a rapid pace. This has created considerable uncertainty.

From a financial health perspective, many SMEs are struggling with cash flow and there is a reduced capacity for working capital and investment opportunities. Local businesses must, therefore, prioritize their cash flow and overall financial health within the short and medium-term.

Government support and representation for the SME sector have not met expectations. Given that small businesses drive the local economy and produce so many jobs, the government must urgently provide more support for SMEs. This will both protect jobs and reduce the economic risk of the ongoing crisis.

The businesses that will survive, and in some cases grow, are those that reduce their risk, review their business direction and proactively plan. A “balanced scorecard” of ensuring staff/people/customers/markets/systems/processes and financial health are at their best, remains the best way to sustain and grow a business. Independent advice, careful planning and implementation could make all the difference in getting through the COVID-19 pandemic.

We hope you have found our Business Sentiment Survey useful. For more information contact:

Dr Dominic Moran | Partner | Business Advisor

-

-